Call us on 09 366 6005

Updates & Articles

GST Changes from April 2023

Topics

New rules modernising GST invoicing and record-keeping requirements will apply from 1 April 2023.

The key change is removing the requirement to issue and hold a “tax invoice” document (which meets certain prescribed requirements on details required), and instead having GST requirements met provided specific GST information is held through various business records, for example commercial invoices or agreements.

You can continue to issue tax invoices as you do now, after 1 April 2023, however the use of tax invoices will now longer be a mandatory requirement and can be replaced instead with “taxable supply information” approach as detailed below.

Tax invoices are replaced by taxable supply information (TSI). This is a set list of information that must be provided to any GST-registered customers within 28 days of the date of supply.

Information over and above current tax invoice requirements includes:

- the ”date of the supply” — when the time of supply is triggered, rather than the current tax invoice requirement of the date on which the tax invoice is issued

- for supplies over $1,000, the TSI must include the recipient's physical address (if that information is available).

For supplies over $200, the changes mean it is mandatory to issue TSI to GST-registered customers within 28 days of the date of supply, and for supplies made to non-GST registered persons you have 28 days from when the customer requests the information.

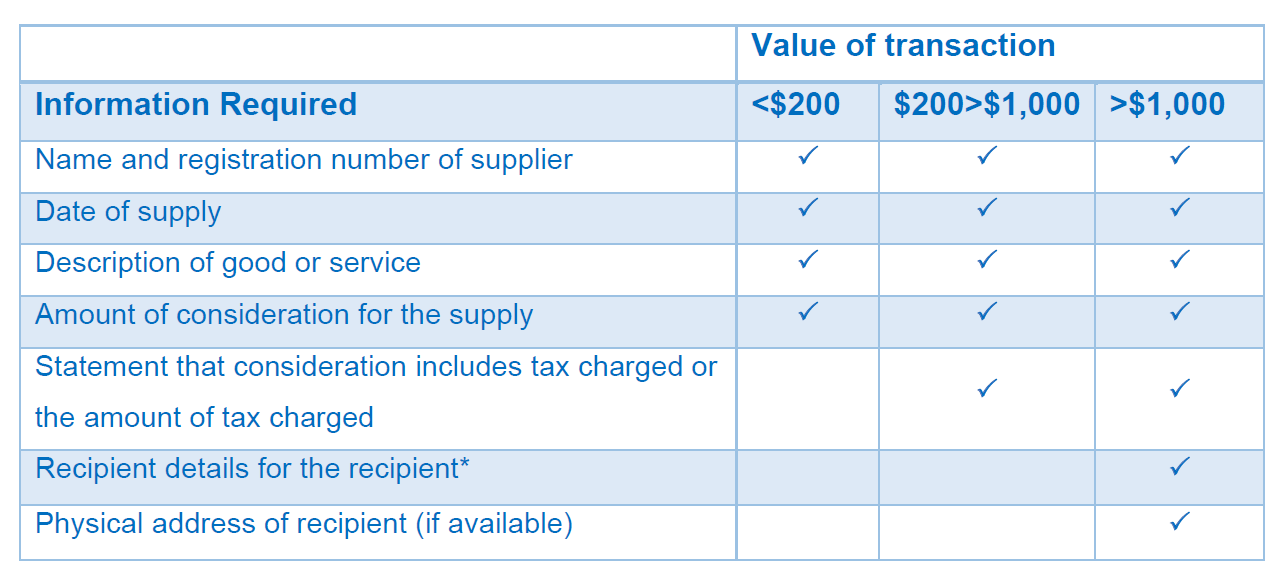

What information is required

With the new rules on GST invoicing applying from 1 April 2023, 'taxable supply information’ is effectively replacing tax invoices and must be retained and able to be provided.

The information required is dependent on the value of the transaction.

*Recipient details require the name of the recipient and one or more of the following:

- Address of a physical location

- Telephone number

- Email address

- Trading name other than the name of the recipient

- New Zealand business number (NZBN)

- Website address

Requirements around credit and debit notes are similarly revised. Formal GST credit and debit notes will no longer be required, however information known as ‘supply correction information’ must be retained. This includes information on inaccuracies corrected such as incorrect descriptions of goods or services, places/times of supply or suppliers/customers.

You must provide supply correction information where the taxable supply information previously provided to a recipient has an incorrect amount of GST, or where you included the incorrect amount of output tax in a GST return. You must provide this information by a date agreed between you and the recipient, or if no date is agreed, within 28 days of the date of the taxable supply information that contained the mistake.

Where the GST shown in the taxable supply information is greater than the eventual GST charged due to a prompt payment discount or an agreed discount which are part of usual business terms, you won’t have to provide the supply correction information.

Buyer-Created Tax Invoices

The new rules on GST invoicing have implications for businesses that use buyer-created tax invoices.

New buyer-created taxable supply information follows the same criteria as the normal taxable supply information being introduced with the changes, depending on the value of the transaction, i.e. whether it’s less than $200, or up to $1,000 etc.

More importantly, you no longer need Inland Revenue approval to use buyer-created taxable supply information (previously required for buyer-created tax invoices). However, both parties to a buyer-created taxable supply arrangement must agree that only the recipient will provide buyer-created taxable supply information and you must record the reasons, if they are not part of the normal terms of business between the parties.

Note any existing Inland Revenue approvals to use buyer-created tax invoices are not affected.

Ask us for advice in relation to the new GST changes on taxable supply information if you are unsure on anything.