Call us on 09 366 6005

Updates & Articles

Changes for Incorporated Societies to comply with the new Act

Topics

Our Advisory Update last week talked about changes happening in the Charities space – in our update here we will focus on important changes coming up for Incorporated Societies.

From 5 October 2023, existing incorporated societies can apply to re-register under the Incorporated Societies Act 2022 (‘the 2022 Act’).

Existing societies will need to re-register under the 2022 Act if they want to remain as an incorporated society. This update will outline what you need to do to re-register.

Existing incorporated societies can apply to re-register any time from 5 October 2023. The final date for re-registration for existing societies is 5 April 2026.

Incorporated Societies Regulations 2023

The Incorporated Societies Regulations came into force on 5 October 2023, which support the implementation of the 2022 Act by prescribing items such as:

a. How incorporated societies apply for registration or re-registration under the 2022 Act;

b. The fees for registration (there are no fees for re-registration of existing societies);

c. Other matters relating to the administration of incorporated societies.

All societies must decide what to do – the sooner the better!

It is very important all incorporated societies actively decide whether to re-register.

If a society decides to re-register, it must start preparing to operate under the 2022 Act, including:

- The society may need to prepare new documents – such as an updated constitution which is compliant with the new Act and officer consent forms;

- The society may need to implement new processes to comply with the Act, such as disputes resolution procedures and how new members consent to being a member of the society;

- The society must have a governing body (its committee). There must be at least 3 people on the committee and every person on the committee is an officer of the society;

- Officers must consent in writing to be an officer and meet eligibility criteria in the Act;

- Other people can also be officers even if they are not part of the elected committee. That would include anyone who holds a position which allows them to exercise significant influence over the management or administration of the society;

- The society will need to hold at least one general meeting to approve any changes required to its constitution and decide upon important matters such as appointment of officers.

If a society decides not to re-register, it may decide to appoint a liquidator or it can apply to be dissolved. In either case, the society should check and follow its constitution/rules, which may set out the steps you must take to deal with the societies assets and debts.

As part of the society’s assessment as to whether to re-register, its governing body may also wish to consider whether the legal vehicle of the society is best serving its needs moving forward. For example, the society may more effectively achieve its purpose through a different legal form such as a charitable trust or company. In these cases, there would be a transitioning process involved transferring the society’s affairs to the new legal vehicle and winding up the incorporated society.

If a society does nothing, the 2022 Act determines what will happen to the society.

- Any society that does not register by 5 April 2026 will cease to legally exist;

- This means it would no longer be an incorporated society which has the following implications:

- This removes your right to make decisions on behalf of the society, such as deciding what happens to the society’s assets. The Registrar could direct how assets are distributed.

- This takes away the separate legal identity the society previously had. This means that members could be held personally liable for debts or obligations owed by the society.

The name of the society will no longer have any protection and could be used by another group to incorporate using the same name.

What does the re-registration process look like

To re-register, societies will need to complete an online application via the Incorporated Societies Register and provide certain information about the society. All societies will need to:

- Provide the society’s constitution (which will need to be compliant with the 2022 Act);

- Include appropriate dispute resolution procedures in the constitution;

- Have a committee that is responsible for managing the operation and affairs of the society;

- Have at least 10 members;

- Provide relevant contact details for the Registrar in order to contact the society.

Once your society has re-registered

After a society has re-registered, it must operate under and comply with the 2022 Act.

This means, for example, the society will need to:

- Hold its annual general meeting (AGM) within 6 months of its end of financial year

- Prepare its financial statements to new standards – for small societies these are the minimum standards set down in the 2022 Act; for all other societies these are the accounting standards set by the External Reporting Board (XRB)

- File an annual return and its financial statements with the Registrar within 6 months of its end of financial year

- Continue to have at least 10 members at all times and ensure all new members consent to becoming a member

- Maintain an up-to-date Register of members

- Keep an Interests Register and a record of any conflicts of interest of officers

What it means to be an Officer

The 2022 Act sets out the definition and obligations of an officer. Officers must consent in writing to be officers and meet eligibility criteria. The 2022 Act defines 6 specific officer duties.

As an officer you must:

- Act in good faith and in the best interests of the society

- Exercise powers for proper purposes only

- Comply with the Act and your society’s constitution

- Exercise reasonable care and diligence

- Not create a substantial risk of serious loss to creditors

- Not incur an obligation the officer doesn’t reasonably believe the society can perform

Incorporated Societies Committees

Committee members are chosen by the society to manage, direct and supervise its affairs. Each person on the committee is an officer of the society.

The 2022 Act does not specifically set out officer roles, however the committee roles may include roles such as a Chairperson, Treasurer and Secretary. Society committees must have at least 3 members and the majority of the committee must be members of the society.

The society’s constitution will need to contain clauses which outline things such as:

- The make-up of the committee (how many officers and any specific roles)

- What the committee’s functions and powers will be

- How officers are elected and how they are removed

Interests Register

Under the 2022 Act, societies must keep and maintain an Interests Register, which records conflicts of interest. An interests register is where a committee keeps a record of an officer’s interests and ensures those involved in running a society are aware of them.

This can include any situation where an officer’s personal interests, obligations or relationships could interfere with their ability to act in the society’s best interests.

Officers have a duty to disclose interests to the committee. Officers must make this disclosure as soon as they become aware they have an interest in any matter being considered by the committee.

The new financial reporting requirements

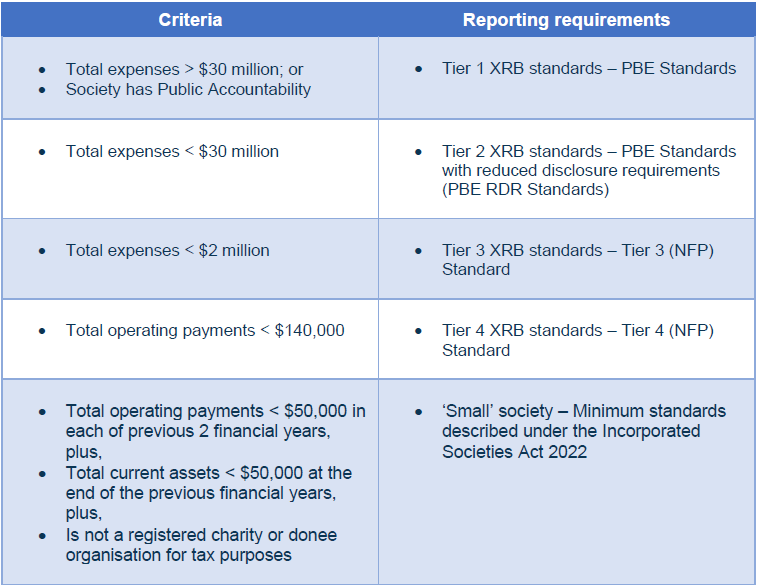

All incorporated societies registered under the 2022 Act (existing societies who have re-registered and new societies which have registered) will be required to prepare and file annual financial statements within 6 months of the society’s reporting date (their end of financial year). The reporting requirements for the incorporated society will be determined from the society’s size and public accountability.

Refer to the table below for a summary of the reporting requirements:

What to do next?

There is a lot for incorporated societies to think about and prepare for in order to comply with the Incorporated Societies Act 2022. This is plenty of time to work through what these changes mean for your society and how to respond to the changes, however the clock has started with the closing re-registration date set at 5 April 2026.

There are substantial resources available to navigate through these changes, in particular resources available on the Companies Office and Registrar of Incorporated Societies websites.

Lynch & Associates are well placed to assist you in understanding how any of these changes specifically impact upon your society and we are here to help.

We are always available to assist you with any questions, queries or help you may need, please do contact us if you need any help.